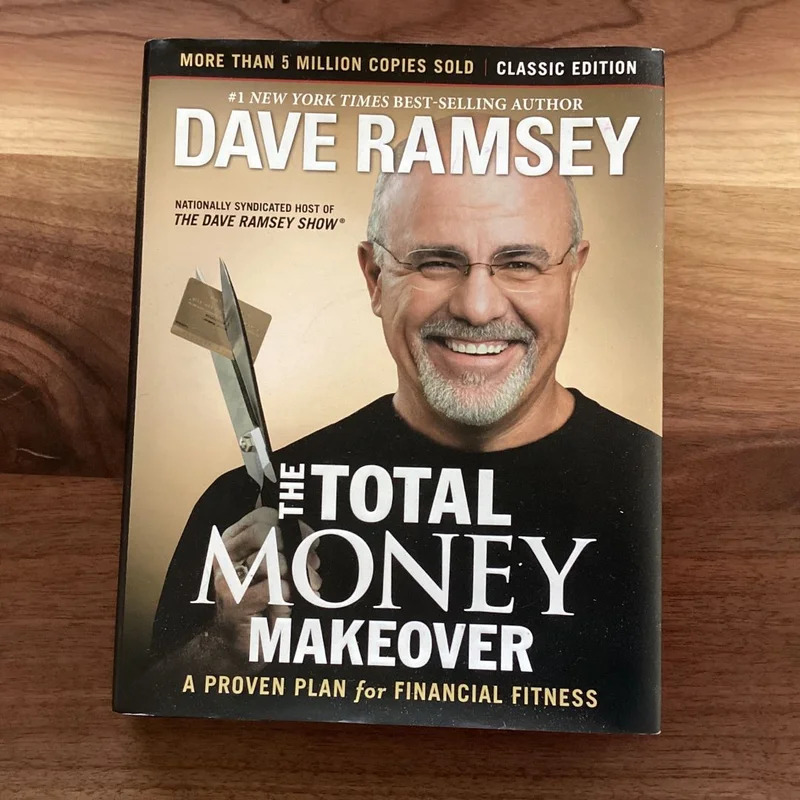

“The Total Money Makeover” isn’t just a book with wise exhortations and steps that can work. Dave Ramsey incorporates financial life skills that not only worked for him but have been and still are working for thousands of American families and individuals.

His book made a mark in my financial life at the best time; when I was nearly getting auctioned because of a loan I had taken and failed to pay for over a year. I had all the universal reasons for not having enough money, plans to pay (only in the mind), and banking on hope as a strategy all the while continuing to take other smaller debts and basking in a lifestyle I was unable to bankroll.

I am a Kenyan, and so for some time, I wondered if this applied to me until I got the myths about money. These I found out to be the same ones I had.

He provides step-by-step actions you can choose to take if you are tired of being tired. Only for those done with being on the wrong side of money. Not only does he advise on the means of stopping borrowing and paying debts, but he also gives steps on how to make viable investments that’ll lead to wealth that’s worth it. He does this with a lively and funny attitude.

How about the life stories of men and women who decided to do the steps??? Amazing!

His plan involves common practices that yield uncommon results. Well-known steps that many think impossible.

He proposes “The 7 Baby Steps” in which he explains and guides the reader to a total money refashion.

These steps include;

- Saving an emergency fund

- The Debt Snowball

- Finishing the emergency fund

- Maximizing retirement investment

- College funding for the kids

- Paying off your home

- Building wealth

I am still on the debt snowball – Baby Step 2. My mindset about money and debts has been significantly altered for my success.

Get this book and change your financial life. In addition to the book, listen to his podcast and YouTube videos to get the hang of everything they talk about.

It is a financial revolution.