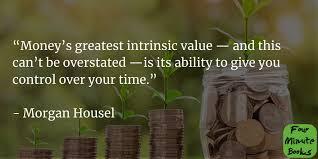

‘The Psychology of Money‘ by Morgan Housel is groundbreaking literature that delves into a subtle side of money – “behavior”. Deriving from a brief history of ‘The Great Depression’ (1929-1939), the author maintains that ‘how’ people behave is more important than ‘what’ they know about money.

According to Morgan, money follows the path of behavior put out by the holder. This is his main idea in the book.

He adds that when considering wealth, people should make allowance for both luck and risk which he makes known as the yin and yang of becoming wealthy. Opposites that both have wild sway on the outcome of money management.

Additionally, he expounds on ideas that the reader should consider to experience true wealth which according to him, isn’t the visible; presenting a concise difference between being ‘rich’ and being ‘wealthy’ in terms of what we can see. Oh, this was an eye-opener!

Among these ideas, he encourages saving, allowing room for errors, expecting changes in plans, and being reasonable rather than rational.

He has also amply analyzed investment, which he discloses as one of the areas that has aided him create wealth. Encouraging the reader to develop this skill, he offers various aids that target ‘time’ and ‘compounding’ as the true wealth-creating allies.

I love the way he brings out how my behavior directs my financial management. It became evident in my life – as I continued reading through – how wrong I was and how skewed my consideration for what the path to wealth was.

Two of the best quotes I noted from Morgan’s book are about the paradox created between our way of practice and our intimate desires. Reading in part ”…most people, deep down, want to be wealthy. They want freedom and flexibility, which financial assets not yet spent can give you. But it is so ingrained in us that to have money is to spend money that we don’t get to see the restraint it takes to actually be wealthy. And since we can’t see it, it’s hard to learn about it.”

The other is “there is only one way to stay wealthy: some combination of frugality and paranoia.”

The other thing to consider is the short and self-sufficient topics he uses. You can skip to any topic of interest and gain understanding without complimenting it with different areas of the book.

I recommend this book first to my daughters since there is so much here that I was never privy to while in school. This would provide a great base for their financial lives. Also, to everyone interested in personal financial management, debt, financial success, and understanding the power behind the use of money. This book reminds me of other related books like “The Total Money Makeover” by Dave Ramsey and “Why We Buy” by Paco Underhill

You are welcome to try it. Let me know what you think!